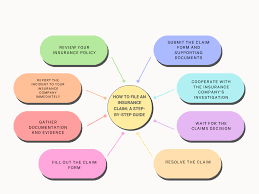

How to File an Insurance Claim

Documenting an insurance claim can be an overwhelming errand, particularly when confronted with the pressure of managing the repercussions of an unforeseen occasion. Whether it’s a car crash, an overwhelmed storm cellar, or a health-related crisis, having an unmistakable comprehension of the insurance claim interaction can incredibly work on the method. In this article, we will direct you through the means of recording an insurance claim, furnishing you with the important information to explore this frequently complicated process without a hitch and successfully.

1. Figure out the insurance policy.

Prior to recording an insurance claim, having an unmistakable comprehension of your insurance policy is essential. Getting some margin to survey your policy completely can save you from possible disappointments and guarantee a smoother claims process. By looking into, as far as possible, deductibles and particular prerequisites or cutoff times for recording a claim, you will be better prepared to explore through the cycle.

Perusing your insurance policy might appear to be an overwhelming errand, yet separating it into sensible segments can make it considerably more congenial. Start by analysing as much as possible. These cutoff points direct the greatest sum the insurance organisation will pay for a specific claim. They can change contingent upon the kind of inclusion you have, like health insurance, auto insurance, or homeowner’s insurance.

Understanding the deductible is one more significant part of your policy. A deductible is how much cash you are liable for paying personal expenses before your insurance inclusion kicks in. Ensure you know the specific deductible amount for your policy, as it will influence the amount you get from your claim.

Notwithstanding inclusion cutoff points

It’s fundamental to recognise particular prerequisites or cutoff times framed in your policy. Different insurance organisations might have particular rules for recording a claim. For example, certain strategies might expect you to report an episode within a particular time span, while others might have explicit documentation prerequisites. Understanding these subtleties ahead of time can forestall superfluous deferrals or claim disavowals.

To get an exhaustive handle on your policy, survey the record completely. While it could be enticing to skim over the policy, plunging into the fine print will assist you with uncovering crucial data. Be on the lookout for any constraints or prohibitions that might affect your claim. A few strategies have limitations on specific things or occasions, so understanding those subtleties can assist you with better grasping what is covered and what isn’t.

Assuming you go over any terms or language that you are new to, consider contacting your insurance specialist or organisation for an explanation. They can assist you with seeing any complicated terms or ideas, guaranteeing that you have a strong handle on your policy’s subtleties.

By completely understanding your insurance policy, you will be more ready to unhesitatingly file a claim. At the point when the opportunity arrives to take part in the claims cycle, this information will act as a significant asset. It will assist you with exploring through the administrative work effectively, fulfil any essential time constraints, and guarantee that you get the fitting pay.

2. Record the episode.

With regards to documenting an insurance claim, one of the most urgent advances is gathering proof to help your case. Insurance organisations depend vigorously on documentation, so it’s fundamental to give as much proof as could be expected to reinforce your claim. In this segment, we will talk about different procedures you can use to successfully record the episode.

The most important step is to take clear and definite photographs or recordings of the harm or misfortune. In the age of cell phones, catching visual proof has become less complex than at any time in recent memory. Make a point to catch numerous points, close-ups, and wide shots to give a far-reaching perspective on the circumstances. Centre around the areas of concern and any apparent harm. Keep in mind that the more visual proof you have, the better it is for your claim.

Notwithstanding visual documentation, it is similarly critical to go with the photographs or recordings with a nitty-gritty depiction of the episode. Make certain to record significant subtleties like the date, time, and area of the episode. Portray what occurred in sequential request and incorporate any pertinent data that could end up being useful to help your claim. The portrayal ought to be as clear and explicit as possible, featuring central issues that can assist your insurance company in figuring out the degree of the harm or misfortune.

Assuming that there were any observers to the occurrence, attempt to acquire their assertions to additionally fortify your claim. Witness proclamations can add validity to your case and give extra viewpoints on what happened. Move towards people who were available during the occurrence and amiably request their records of the occasions. Demand that they incorporate their contact data and sign the explanation to validate it.

Specific Circumstances

Including specialists, for example, the police or a local group of firefighters, it is fundamental. On the off chance that it is pertinent, file a report with the significant power and request a duplicate for your own records. These authority reports carry a significant weight in insurance claims and can provide an unprejudiced record of the occurrence. Helping out specialists and providing any necessary data will assist in guaranteeing that your claim is legitimate.

Make sure to accumulate any extra important documentation, for example, clinical records, fix gauges, or solicitations for harmed or taken property. These records act as proof of the degree of the harm or misfortune and the costs caused accordingly. Make duplicates of all your documentation so you can give the first copies to your insurance organisation while holding duplicates for your records.

3. Advise your insurance organisation immediately.

With regards to documenting an insurance claim, immediacy is vital. After the awful occurrence happens, the first and most significant step is to contact your insurance supplier as quickly as time permits. By telling them quickly, you can guarantee a smoother and more effective cycle for getting enough remuneration. In this part, we will talk about the significance of immediately reaching your insurance organisation and the pertinent subtleties you want to convey.

When the occurrence happens, it is urgent to get on the telephone or the PC and contact your insurance organization. The sooner you inform them about what occurred, the better possibilities you have of settling your claim rapidly and actually. Numerous insurance organisations have explicit time limits for detailing occurrences, so it is vital to act expeditiously to stay away from any expected confusion or refusal of inclusion.

At the point when you contact your insurance supplier, you ought to be ready to give every one of the applicable insights regarding the episode. This incorporates significant data like the date, time, and area of the occasion. Try to give exact and explicit data to assist with smoothing out the interaction. The more exact subtleties you can offer, the better your insurance organisation can comprehend what is happening and pursue proper choices in regards to your claim.

Notwithstanding the episode subtleties

It is vital to observe the name and contact information of the delegate you talk with. Writing down this data will prove to be useful for future reference, particularly on the off chance that you want to circle back to your claim or have any further inquiries with respect to the cycle. Along these lines, you can undoubtedly allude back to the individual you at first talked with, guaranteeing a smoother and more customised insight all through the claim cycle.

Keep in mind that while advising your insurance organisation, it is essential to stay cool and gathered. Make sense of the episode, obviously, and focus on what’s relevant. Telling the truth and being straightforward about the circumstances will assist with laying out trust and validity, improving the probability of a positive result for your claim.

At times, your insurance supplier might require extra documentation to help with your claim. This documentation could incorporate police reports, clinical records, photographs of the harm or wounds, and some other proof pertinent to the episode. Be ready to give these extra records quickly whenever mentioned, as they assume a crucial role in approving your claim.

Whenever you have advised your insurance organisation and given all the important data, it is essential to keep up with open correspondence all through the claim cycle. Monitor the advancement and circle back to your insurance supplier occasionally to guarantee everything is pushing ahead without a hitch. Make note of any correspondence, including dates, times, and names of the people you talk with, to remain coordinated and informed.

Conclusion

By instantly informing your insurance organisation and giving every single significant detail, you establish the groundwork for a fruitful claims process. Make sure to track all cooperation and update your insurance supplier with any extra documentation they might require. With legitimate correspondence and collaboration, you can explore the claims cycle productively and get the inclusion .code Boexcellent 2822