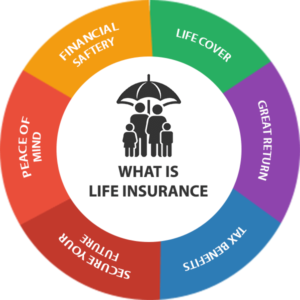

What Is Life Insurance

Life insurance is a theme that frequently springs up in discussions about monetary preparation and security. Be that as it may, what precisely is life insurance, and for what reason is it a particularly significant part of dealing with our future? Set forth plainly, life insurance is an agreement between an individual and an insurance organization, determined to give monetary security to friends and family in case of the protected individual’s demise. It offers a method for guaranteeing that those abandoned will actually want to help themselves monetarily, as the policy pays out an amount of money, known as the demise benefit, to the recipients recorded by the policyholder.

1. Life insurance in straightforward terms: Figuring out the nuts and bolts

Life insurance is an agreement between an individual, alluded to as the policyholder, and an insurance organization. Giving monetary assurance to the policyholder’s recipients in case of their death is planned. In return for normal premium installments, the insurance organization consents to pay out a predetermined measure of money, known as the demise benefit, to the recipients upon the policyholder’s passing.

Fundamentals of life insurance

Understanding the fundamentals of life insurance can be important for anybody searching for monetary security and genuine serenity for their friends and family after they are no more. While it might appear to be complicated from the start, the idea of life insurance is somewhat direct.

One of the critical parts of life insurance is the policyholder. This is the individual who holds the insurance policy and pays the premiums. The policyholder can decide to be an individual or a business element, contingent upon their conditions and needs. The policyholder is typically the individual whose life is being safeguarded, yet it is additionally conceivable to have a life insurance policy on another person’s life, similar to a companion or a youngster, if there is an insurable interest.

Then, we have the recipients. These are the people or elements picked by the policyholder to get the demise benefit when they die. The recipients can be at least one individuals, and they can likewise be changed as the policyholder’s conditions change. Recipients can utilize the demise advantage to cover burial service costs, take care of obligations, supplant lost pay, or backing some other monetary requirements they might have.

Installments

These are one more basic component of life insurance. These are the customary installments the policyholder makes to the insurance organization to keep the policy dynamic. Premiums can be paid month to month, quarterly, semi-every year, or every year, contingent upon the policyholder’s preference. How much the still up in the air by different elements, like the policyholder’s age, health, occupation, lifestyle, and the inclusion sum wanted.

Similarly as with all insurance policies, life insurance is likely to guaranteeing. Endorsing is the cycle by which the insurance organization decides if to give a policy to the candidate and at what premium rate. During the endorsing system, the insurance organization assesses the candidate’s gamble factors, for example, their clinical history, current health conditions, propensities like smoking or drinking, and at times might require a clinical assessment.

Life insurance contracts come in various types, to be specific term life insurance and super durable life insurance. Term life insurance gives inclusion to a particular period, ordinarily going from 10 to 30 years. Assuming the policyholder passes on inside the term and the policy is in force, the demise benefit is paid to the recipients. Extremely durable life insurance, then again, offers inclusion for the policyholder’s whole life as long as the premiums are paid. Super durable policies likewise have a money esteem part that develops over the long run, which can be acquired against or removed on a case by case basis.

Significance

2. For what reason is life insurance significant? Safeguarding your friends and family monetarily

Losing a friend or family member is a sad truth of life. Notwithstanding the profound cost it takes, it can likewise bring monetary difficulties, particularly in the event that the departed was the essential provider or a critical supporter of the family’s pay. This is where life insurance assumes a significant part – it can assist with protecting your family’s monetary solidness during what is as of now a troublesome time.

One of the primary justifications for why life insurance is significant is its capacity to supplant the pay that would be lost when a breadwinner dies. In the event that you are the essential pay worker in your family, have you at any point halted to contemplate what might befall your wards assuming you were no longer there to monetarily accommodate them? Life insurance steps in to overcome this issue, guaranteeing that your friends and family can keep on gathering their everyday requirements, even after you’re gone.

Monetary security net

Youngsters’ schooling is one more pressing worry for some guardians. Quality schooling is frequently costly and is a fundamental interest in your kid’s future. Life insurance can act as a monetary security net, empowering your kids to seek after their instructive dreams, paying little heed to what befalls you. By naming your kid or mate as the recipient of your life insurance policy, you can guarantee that the necessary subsidizes will be accessible for their schooling, regardless of whether you are not.

Additionally, life insurance can likewise be an instrumental device in taking care of remarkable obligations or home loans. Many individuals carry critical monetary liabilities, for example, a home loan, car credits, or Mastercard obligation. Assuming you die startlingly, your wards could become troubled with these monetary commitments. However, a life insurance policy can give the assets important to settle these obligations, facilitating the monetary burden on your friends and family during a generally troublesome time.

Moreover, life insurance can assist with covering memorial service and internment costs, which can be significant. Memorial services alone can cost great many dollars, and these costs can add up rapidly, leaving lamenting relatives with a strong bill. By having a life insurance policy set up, you can guarantee that your family isn’t left battling to cover these costs, empowering them to zero in on lamenting and recuperating without the additional monetary pressure.

Other aspects

Moreover, life insurance can likewise go about as a domain arranging device, giving a wellspring of legacy to your friends and family. This can be particularly relevant to leave a monetary inheritance for your loved ones. By including a life insurance policy as a component of your bequest plan, you can guarantee that your relatives get a financial advantage, regardless of whether your different resources are restricted or inaccessible at the hour of your passing.

3. Various types of life insurance policies: Term, entire life, and then some!

Life insurance is a urgent monetary device that gives monetary security to your friends and family in case of your unfavorable downfall. It guarantees that they can adapt to the deficiency of your pay and keep on gathering their monetary commitments. On the off chance that you are thinking about getting life insurance, it’s vital to comprehend the various types of life insurance policies accessible. In this part, we will investigate the three principal types of life insurance: term, entire life, and that’s just the beginning!

Term life insurance

It is the most clear and reasonable kind of life insurance policy. As the name recommends, it gives inclusion to a particular term, regularly going from 10 to 30 years. On the off chance that you die during the term of the policy, your recipients will get a passing advantage to help monetarily safeguard them. However, assuming that you outlast the term of the policy, it will lapse, and you won’t get any advantages. Term life insurance is an incredible decision to guarantee monetary security during a particular period, for example, when you have wards or a home loan to pay off.

Then again, entire life insurance offers inclusion for your whole lifetime, as long as you keep on paying the premiums. One of the huge benefits of entire life insurance is that it gives a demise benefit while likewise offering a reserve funds part known as money esteem. A piece of your premiums is contributed by the insurance organization, which develops after some time and gathers as money esteem. This money worth can be gotten to by you during your lifetime through policy credits or withdrawals, which can be helpful for crises or as a wellspring of supplemental pay in retirement. Entire life insurance is a more comprehensive and long haul arrangement contrasted with term life insurance.

Insurance contracts

Moreover, there are varieties of entire life insurance contracts, like widespread life insurance and variable life insurance. Widespread life insurance is like entire life insurance, yet it offers greater adaptability as far as premium installments and demise benefit sum. With this sort of policy, you can change your premium installments inside specific cutoff points and possibly increment or diminishing your inclusion sum, contingent upon your requirements. Variable life insurance, then again, permits you to put away the money esteem part of your policy in a scope of speculation choices, like stocks and securities. This gives you the potential for more significant yields yet in addition accompanies a more elevated level of chance.

Conclusion

Ultimately, there are particular life insurance policies accessible, like last cost insurance and recorded general life insurance (IUL). Last cost insurance, otherwise called internment insurance, is intended to take care of the costs related with your memorial service and last costs. This sort of policy regularly offers lower inclusion sums and is simpler to fit the bill for, making it an ideal choice for people who are more established or have health conditions. IUL consolidates the advantages of widespread life insurance with the possibility to procure revenue in light of the exhibition of a market record. It permits you to collect money esteem while additionally safeguarding your friends and family monetarily.

More learn importance of insurance