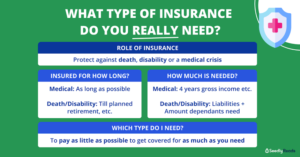

- What Types of Insurance Do I Truly Need?

Insurance is a critical part of our lives, providing genuine serenity and monetary security in the midst of surprising occasions. However, with the extensive variety of insurance choices accessible, it tends to be overwhelming to figure out which policies are really essential for you. Whether you are a homeowner, a parent, a driver, or a businessperson, understanding the types of insurance that are most significant can assist you with pursuing informed choices and safeguarding yourself and your resources. In this article, we will investigate the key insurance policies that people ordinarily need, revealing insight into how they work, what they cover, and why you ought to consider having them. By acquiring a superior comprehension of your insurance needs, you can guarantee that you are satisfactorily safeguarded for life’s flighty minutes.

1. Presentation

Figuring out the significance of insurance

Insurance assumes a fundamental role in our lives, providing monetary security and true serenity during uncertain times. From protecting our health and property to guaranteeing the monetary strength of our friends and family, insurance goes about as a wellbeing net when the unexpected happens. In this segment, we dig into the significance of insurance and investigate why it is a high priority in the present speedy world.

Life is loaded with vulnerabilities, and keeping in mind that we can’t anticipate the future, we can unquestionably be ready for it. Insurance goes about as a cradle against unforeseen occasions that might actually disturb our lives and cause monetary difficulties. Whether it is a sickness, a mishap, a cataclysmic event, or the passing of a friend or family member, insurance gives a layer of security and backing during these difficult times.

Health insurance

For some, health insurance is the most well-known type of insurance, as it gives access to quality clinical care and safeguards against soaring healthcare costs. Health-related crises can be monetarily depleting, and without appropriate inclusion, the weight of clinical costs can immediately become overwhelming. Health insurance offers monetary security as well as guarantees that people get the essential clinical consideration immediately. It provides a security net, permitting us to focus on our prosperity as opposed to stressing over the monetary repercussions of getting treatment.

Notwithstanding health insurance, it is additionally pivotal to safeguard our most critical investment—our homes. Homeowners insurance covers harm to the property as well as gives obligation security in the event that somebody is harmed in the vicinity. Our homes are inclined to different dangers like fire, burglary, catastrophic events, or mishaps, and having legitimate inclusion mitigates the monetary strain related to these lamentable occasions. Insurance permits us to reconstruct and recuperate, notwithstanding difficulty.

Auto insurance

Moreover, for people who own vehicles, auto insurance is a legal necessity in many locales. Aside from being a lawful commitment, auto insurance safeguards against monetary misfortune in the event of mishaps, robbery, or harm to our vehicles. Whether it is a minor collision or a significant impact, a proper insurance policy guarantees that fixes and clinical costs are covered, giving us genuine serenity while out and about.

Insurance is particularly huge for families with children. Life insurance gives the affirmation that friends and family will be financially safeguarded in case of the policyholder’s unfavourable demise. It fills in as a wellbeing net, supplanting lost pay and covering costs, for example, contract installments, schooling costs, and everyday costs. By giving monetary dependability to our friends and family, life insurance permits us to care for them in any event, when we are never again near.

Other aspects

In addition, insurance goes beyond safeguarding our health, homes, and vehicles. It stretches out to different areas like travel insurance, pet insurance, and business insurance. No matter what the particular kind, insurance guarantees that we can explore life’s vulnerabilities with certainty and strength.

2. The insurance essentials you can’t stand to neglect:

With regards to safeguarding your monetary future, insurance assumes an essential role. While exploring the universe of insurance can at times feel overwhelming, understanding the essentials you can’t stand to neglect is essential for protecting your resources and prosperity. In this segment, we will cover the insurance policies that ought to be at the top of your list of needs.

1. Health Insurance:

Without a doubt, your health is one of your most noteworthy riches. As clinical costs keep on rising, having health insurance is fundamental to guaranteeing you get essential care without causing overpowering costs. An exhaustive health insurance policy covers specialists’ visits, clinic stays, medicine, and other clinical benefits. Make certain to carefully audit the inclusions and advantages presented by various health insurance plans to track down the one that best addresses your issues.

2. Auto Insurance:

On the off chance that you own a car, having auto insurance isn’t simply a wise monetary choice but additionally a legal necessity in many areas. Auto insurance safeguards you financially if there should be an occurrence of a mishap, burglary, or any harm caused to your vehicle. Additionally, it includes the risk of real wounds or property harm you might cause to other people. While the particular inclusion choices and costs might change, having auto insurance is non-debatable for any car proprietor.

3. Homeowner’s Insurance:

Your home is reasonable for your most huge speculation, which is why having homeowner’s insurance is critical. This policy safeguards your property against dangers like fire, burglary, defacing, and catastrophic events. Also, it gives obligation inclusion in the event that somebody gets harmed on your property. Homeowner’s insurance gives you an inward feeling of harmony as well as assists you with recuperating from unexpected occasions without depleting your reserve funds.

4. Tenant’s Insurance:

Regardless of whether you own your home, tenant’s insurance is a frequently ignored policy that can be priceless in safeguarding your assets. While your landowner’s insurance covers the construction, it ordinarily doesn’t cover your own belongings. The tenant’s insurance gives inclusion to your assets if there should be an occurrence of robbery, fire, or other covered hazards. Moreover, it frequently incorporates responsibility inclusion, covering you assuming somebody gets harmed in your leased space. Leaseholder’s insurance is an affordable choice that assists you with guaranteeing the security of your possessions.

5. Life Insurance:

While it may not be the most charming subject to contemplate, life insurance is priceless with regards to the monetary prosperity of your friends and family in case of your troublesome passing. Life insurance gives a payout, known as the demise benefit, to your recipients upon your passing. This money can be utilised to supplant your pay, take care of obligations, cover memorial service costs, or asset your youngsters’ schooling. The type and measure of life insurance you want will depend on factors like your age, monetary commitments, and wards.

3. Health insurance: safeguarding your prosperity and funds

Health insurance is a critical type of security that everybody ought to genuinely consider having. It protects your prosperity as well as gives monetary security if there should arise an occurrence of unforeseen clinical costs. In this segment, we will dig into the significance of health insurance and how it can help you, your friends, and your family.

Health related crises

It can emerge whenever, and when they do, it is critical to have health insurance set up to assist with taking care of the costs related to treatment. Without insurance, even a normal visit to the specialist can turn into a costly undertaking. Doctor-prescribed medications, lab tests, medical procedures, and emergency clinic stays can amount to a significant sum, possibly leaving people and families troubled with overpowering hospital expenses.

Having health insurance guarantees that you can approach fundamental clinical care without stressing over the monetary strain. It gives inclusion to a great many clinical benefits, including preventive care, specialist counselling, clinic stays, drugs, and, surprisingly, specific medicines. By having inclusion, you can look for clinical consideration quickly while required, permitting you to address health worries before they grow into additional difficult issues.

Besides, health insurance offers a security net even in unexpected crises. Mishaps and basic ailments can strike anybody, paying little mind to progress in years or lifestyle decisions. When confronted with such circumstances, health insurance offers essential monetary help to assist with taking care of the expenses of crisis medicines, medical procedures, and hospitalization. It safeguards your actual health as well as shields your monetary prosperity, keeping you from falling into devastating obligations because of clinical costs.

Clinical necessities

Past quick clinical necessities, health insurance likewise assumes a huge part in advancing by and large prosperity. Most insurance plans incorporate preventive measures like immunisations, screenings, and yearly check-ups. These preventive measures can help identify and treat health issues at an early stage, keeping them from forming into more extreme circumstances. By having insurance, you are bound to get ordinary health check-ups and follow-up medicines, prompting better long-term health results.

Benefits

One critical benefit of health insurance is its capacity to give admission to a wide organisation of healthcare suppliers. Insurance policies, as a rule, have an organisation of specialists, clinics, and experts that are covered under the arrangement. This organisation guarantees that you have various choices accessible for clinical care, permitting you to pick healthcare experts who line up with your inclinations, be it proximity, particular aptitude, or individual suggestions.