Ways To Lower Your Insurance Costs

Could it be said that you are burned out on seeing your well-deserved money being depleted by rising insurance costs? Indeed, stress is no more! We comprehend the monetary strain that insurance premiums can put on your wallet, which is why we’ve assembled this article to assist you with lowering those costs. In the accompanying sections, we will investigate a few pragmatic and successful ways for you to save money on insurance without compromising on your inclusion. In this way, assuming you’re prepared to assume command over your insurance expenses and have more money left in your pocket towards the end of every month, continue to peruse to find the tips and tricks that will assist you with accomplishing only that.

1. Grasping your inclusion

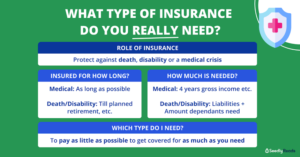

In this day and age, insurance has become an essential piece of our lives. Whether it’s auto, home, health, or life insurance, we depend on these policies to safeguard us from surprising costs and furnish us with inner harmony. However, insurance costs can add up rapidly, leaving numerous people and families battling to stay aware of the premiums. Fortunately, there are multiple ways in which you can lower your insurance costs without settling for less than the inclusion you really want. One urgent move towards this interaction is grasping your inclusion.

Lower Your Insurance Costs

To successfully lower your insurance costs, it’s essential to completely audit your insurance policies. Carve out the opportunity to comprehend what every policy covers and whether you truly need all the inclusion you now have. Frequently, we end up with superfluous or copy inclusions that add to our premiums. By carefully inspecting your policies, you can distinguish these regions and make vital changes.

For example, we should consider your auto insurance policy. Pause for a minute to assess its inclusion perspectives. Do you truly require every one of the extra choices, like rental car repayment or emergency assistance? In the event that these additional items are not critical for your circumstance, eliminating them can assist you with fundamentally decreasing your insurance costs. While exploring your policy, give close consideration to the deductible sum as well. A higher deductible frequently means lower premiums, so on the off chance that you feel OK with a higher personal cost in this case, consider changing your deductible to save on your premiums.

Like auto insurance, home insurance policies can likewise profit from an intensive survey. Guarantee that you comprehend what your policy covers regarding harms, liabilities, and individual property. Assuming there are any regions where you have pointless cross-over or overinsurance, now is the right time to roll out the essential improvements. For instance, assuming you have individual inclusion on costly things that are as of now covered under the policy’s overall inclusion, you may be paying more than needed. Taking out these copy inclusions can be a compelling method for diminishing your insurance costs.

Health insurance

It is one more area where understanding your inclusion can prompt investment funds. Investigate your policy and decide if you have pointless inclusions for administrations that you seldom use. In the event that you end up paying for administrations that you don’t require, for example, maternity or dental inclusion, it could be wise to consider changing your arrangement. Zeroing in on your genuine healthcare needs and choosing a policy that suits you can help lower your premiums without settling for less on essential inclusion.

Finally, remember to audit your life insurance policy. Consider assuming that your inclusion sum is suitable for your ongoing circumstances. Assuming you have paid off the greater part of your obligations, or, on the other hand, in the event that your kids are financially free, you might be overinsured. Changing your inclusion as indicated by your ongoing requirements can assist you with saving money on your premiums without sabotaging the security of your friends and family.

2. Looking for the best rates

With regards to lowering your insurance costs, one of the best methodologies is to look for the best rates. Try not to wrongly agree with the main insurance supplier that goes along. Getting some margin to look at quotes from different insurance organisations might possibly save you a lot of money on your premiums.

It’s critical to comprehend that every insurance supplier might have various rates and limits accessible. By investigating various choices, you can track down a policy that suits your requirements while also remembering your financial plan. Feel free to invest a little extra energy to guarantee you are getting the most ideal arrangement.

Anyway, how precisely could you, at any point, approach looking for the best rates? Indeed, there are a couple of key advances you can make to make the cycle as smooth as could really be expected. Above all else, it’s critical to assemble quotes from numerous insurance organizations. This should be possible either by reaching them directly or by using web-based examination devices. These apparatuses permit you to enter your data once and get quotes from different safety net providers, saving you time and effort.

Mentioning quotes

While mentioning quotes, make certain to give exact and definite data for the backup plans. This incorporates your own subtleties, the sort of inclusion you are searching for, and any pertinent insights concerning your vehicle or property. By giving precise data, you can guarantee that the quotes you get are as exact as could really be expected.

Whenever you have assembled a few quotes, find the opportunity to look at each one carefully. Look past the top-notch cost; consider, as far as possible, deductibles and any extra advantages or limits presented by every safety net provider. Remember that the least expensive choice isn’t generally the most ideal decision on the off chance that it doesn’t provide satisfactory inclusion.

One more significant angle to consider is the standing and monetary security of the insurance organization. While a specific supplier might offer tempting rates, in the event that they have a background marked by unfortunate client support or monetary unsteadiness, it may not merit the gamble. Research the insurance organisation’s evaluations and surveys online to guarantee they have a strong history.

Insurance rates

Importantly, looking for insurance rates ought not be a one-time action. Rates can change over the long run, so it’s smart to intermittently reexamine your insurance needs and acquire quotes from different guarantors. This is especially significant in the event that you experience changes in your conditions, for example, moving to another region, buying another vehicle, or encountering a critical life occasion.

3. Expanding deductibles

One viable procedure to lessen your insurance costs is by expanding your deductibles. By picking a higher deductible, you might actually get a lower month-to-month or yearly premium. However, it is essential to remember that you ought to have an adequate number of reserve funds put away to cover the deductible on the off chance that you want to make a case.

Deductibles

A deductible is how much money you are expected to pay personal before your insurance inclusion kicks in. For example, suppose you have auto insurance with a deductible of $500. Assuming you get into a mishap and the maintenance costs all out $2,000, you would have to pay the $500 deductible, while your insurance would cover the excess of $1,500.

By expanding your deductible, you essentially consent to taking on a bigger piece of the monetary obligation in the event of a case. Thus, insurance organisations frequently reward policyholders who select higher deductibles with lower insurance premiums. This is on the grounds that the insurance organisation’s risk diminishes as your deductible increases.

For instance, on the off chance that you typically pay a $250 deductible for your homeowner’s insurance, raising it to $1,000 might actually bring about observable investment funds on your charge. Essentially, on the off chance that you have a low-deductible health insurance plan, expanding it can assist you with saving money on month-to-month premiums.

Evaluation

However, evaluating what is happening prior to settling on a higher deductible is basic. While it might decrease your insurance costs, it likewise implies that you really want to have an adequate number of reserve funds put away to cover the deductible sum in the event of a case. Thus, consider your spending plan and decide whether you have the fundamental assets to cover the expanded deductible.

Expanding your deductibles might be a practical choice for people who have a decent history of negligible cases. In the event that you seldom make insurance guarantees and have a past filled with being a protected driver or dependably keeping up with your property, expanding your deductible can be a reasonable decision. In such cases, the probability of paying the deductible is generally low, making settling on it an all the more monetarily sound choice.

Conclusion

Then again, on the off chance that you depend vigorously on your insurance inclusion and expect various cases or are not sure about your capacity to cover a higher deductible, it very well might be more fitting to keep your deductible at a lower sum. In circumstances where continuous cases are plausible, the reserve funds obtained by expanding your deductible may not offset the expected monetary weight of paying a critical sum forthright.

Taking everything into account, assuming that you are searching for ways of lowering your insurance costs, expanding your deductible can be a compelling methodology. By choosing a higher deductible, you might have the option of getting a lower month-to-month or yearly premium. However, it is significant to consider what is going on and the capacity to cover the deductible in the event of a case. Survey your case history and individual conditions prior to settling on a choice that lines up with your spending plan and hazard resilience.