Common Insurance Mistakes To Avoid

Insurance is an essential part of our daily existence, giving us a security net in the midst of vulnerability. Whether it’s home, auto, health, or life insurance.we depend on these policies to safeguard ourselves and our friends and family from unexpected conditions. However, exploring the universe of insurance can be precarious. And it’s normal for individuals to commit errors that can have dependable outcomes. In this article.We will investigate some common insurance mistakes to avoid. Revealing insight into the significance of being very informed with regards to safeguarding your resources and your future.

Significance

1. The significance of understanding coverage cutoff points and deductibles.

With regards to buying insurance, having a reasonable comprehension of your coverage cutoff points.And deductibles is essential. While insurance policies provide a safety net in the midst of surprising occasions or fiascos. not completely grasping the agreements can prompt exorbitant mistakes. By carving out the opportunity to instruct yourself about coverage cutoff points. And deductibles, you can guarantee that you settle on informed decisions. and avoid likely traps.

Insurance coverage limits allude to the most extreme measure of money. That an insurance organisation will pay for a particular case or occasion. For instance, assuming you have a car insurance policy with a coverage cutoff of $50,000 for property harm. The guarantor will just repay you up to that sum in the event of a mishap. Understanding these cutoff points is essential. as surpassing them implies you’ll be accountable for taking care of the extra costs from cash on hand.

Policy deductibles

Moreover, you should think about your policy deductibles. A deductible is the foreordained measure of money you want to pay personally before your insurance coverage kicks in. For example, in the event that you have a home insurance policy with a $1,000 deductible . and your home encounters harm worth $5,000, you’d need to pay the $1,000 first. Before the insurance supplier covers the excess of $4,000. Deductibles help insurance organizations limit the payout for routine cases. and urge policyholders to be more wary and dependable.

One common slip-up that people make is picking lower coverage limits. Or higher deductibles to diminish their insurance premiums. While this might appear to be a cash-saving tip temporarily. it leaves you defenseless against monetary difficulties if there should be an occurrence of huge misfortunes. It’s pivotal to find some kind of harmony between affordable premiums .and sufficient coverage. Carefully survey the potential dangers related to different situations .And guarantee that your coverage limits line up with your necessities.

Cutoff points

Another slip-up individuals frequently make is accepting that their coverage cutoff points. And deductibles stay fixed over the long haul. In all actuality, insurance policies can change. And it’s essential to survey them occasionally to guarantee they actually meet your prerequisites. Conditions and resources can change. And keeping steady over these alterations can assist you with refreshing your policy sufficiently. Remember that underinsuring yourself can be pretty much as impeding as not having insurance by any stretch of the imagination. as it can allow you to stay uncovered to high personal costs.

Understanding the complexities of your insurance policy can save you from significant monetary burdens. At the point when a mishap or crisis happens. It tends to be upsetting enough, minus any additional complexities emerging from deficient coverage or surprising expenses. By finding out more about your insurance policy’s coverage cutoff points and deductibles.You can use wise judgement in the midst of an emergency. Guaranteeing that you get the help you want without confronting strong costs.

To acquire a far reaching comprehension

of your coverage cutoff points and deductibles, get some margin to survey your policy records carefully. Make it a point to reach out to your insurance supplier for an explanation. And pose inquiries about unambiguous situations or coverage subtleties that might be hazy. Looking for proficient guidance can be very useful in guaranteeing that you are sufficiently safeguarded.

2. Not assessing and refreshing policies routinely.

It’s not difficult to fall into a daily practice and disregard specific parts of our lives, including insurance. We buy insurance policies to safeguard ourselves, our friends and family. And our resources. However, when those policies are set up, a significant number of us will generally disregard them, expecting that all is well as long as the premiums are paid on time. This can be a significant mix-up. Consistently surveying and refreshing your insurance policies is critical to guaranteeing that you have sufficient coverage, avoid astonishments, and take advantage of your insurance benefits.

Refresh your policies

Life is flighty, and conditions change over the long haul. As you carry on with various phases of life. Your insurance needs can develop too. Neglecting to audit and refresh your policies can leave you weak in different ways. Here are a few motivations behind why routinely investigating is essential and why it is essential to refresh your insurance policies:

1. Changes in Life: Life is brimming with achievements and huge occasions that can affect your insurance needs. Getting hitched, having youngsters, purchasing another home. Or beginning a business are only a couple of instances of life changes that ought to incite a survey of your insurance coverage. Assuming you neglect to refresh your policies to mirror these changes, you might wind up with deficient coverage that doesn’t satisfactorily safeguard your new conditions.

2. Economic situations

Insurance is a unique industry, and the market scene is continually developing. Insurance organisations are consistently presenting new items, altering their coverage choices. And changing charge rates to stay aware of evolving requests. By evaluating your policies consistently, you can remain informed about the most recent contributions. And exploit any new advantages or limits that might be accessible. Furthermore, you can guarantee. That you’re not paying more than needed for your coverage by looking at rates and quotes from various backup plans.

3. Expansion and Resource Worth: After some time, the worth of your resources, like your home, car, or business, may expand. Because of expansion or appreciation. In the event that your insurance policies don’t precisely reflect the ongoing worth of these resources. you might be left underinsured. Checking on and refreshing your policies permits you to change your coverage likewise. guaranteeing that you can reconstruct or supplant your resources in case of a misfortune.

4. Changing Gamble Factors

Your gamble openness can change over the long haul. For example, as you age, your health risks might increase, so checking your health insurance policy is critical. On the off chance that you’ve made enhancements to your property’s wellbeing highlights or added security frameworks. refreshing your home insurance policy might possibly decrease your premiums. Consistently investigating your policies permits you to address these changing gambling factors and guarantee that you have the right coverage to safeguard against them.

5. Augmenting Advantages

Insurance policies frequently give extra advantages or highlights that you may not know about. By auditing your policies, you can reveal these secret advantages and upgrade your coverage. For instance, your home insurance could cover harm brought about by catastrophic events, like floods or quakes, unbeknownst to you. Distinguishing these advantages and exploiting them might possibly save you from unforeseen monetary burdens.

3. Neglecting the meaning of extra coverage choices.

With regards to buying insurance, many individuals will quite often focus exclusively on the essential coverage choices. While it’s pivotal to guarantee that you have satisfactory assurance for your home, car, or health, ignoring the meaning of extra coverage options is similarly significant. These extra coverage choices can provide you with added monetary security and shield you against unforeseen costs. In this segment, we will investigate three common mistakes that buyers make by neglecting the meaning of extra coverage choices.

1. Misjudging the worth of umbrella insurance:

One essential coverage choice that is frequently disregarded is umbrella insurance. This extra coverage blows away your standard responsibility coverage limits. Umbrella insurance kicks in when your essential insurance policy limits have been depleted. It gives you an extra layer of security and can be a lifesaver in circumstances where you are confronted with a huge obligation guarantee.

For instance, suppose you’re involved in a car crash that exceeds your auto insurance risk limits. In the event that you have umbrella insurance, it can take care of the leftover expenses, like clinical costs, legitimate charges, or harms, assuming you’re sued. Without umbrella insurance, you could actually be responsible for these costs, possibly prompting monetary ruin. It’s critical to consider the potential dangers you might face in your day-to-day existence and evaluate whether umbrella insurance would be valuable for your circumstances.

2. Failing to buy thorough coverage for auto insurance:

One more commonly disregarded coverage is far-reaching insurance for your vehicle. Many individuals expect that, assuming they have impact coverage, they are completely safeguarded. However, crash coverage just pays for harm coming about because of mishaps where you slam into another vehicle or item. Extensive coverage, then again, safeguards you against a more extensive scope of occurrences, including robbery, defacing, cataclysmic events, and even harm brought about by creatures.

Conclusion

Consider a situation where your vehicle is left in the city and a fallen tree harms it during a serious storm. Assuming that you just have impact coverage, you might need to bear the maintenance costs yourself. However, assuming that you had complete coverage, it would assist with covering the costs, diminishing the monetary burden on you. Evaluating your dangers and choosing extensive coverage appropriately can forestall unforeseen costs and give you inner harmony.

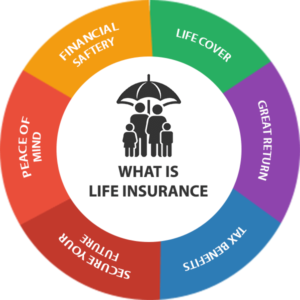

More learn what is life insurance